Insurance

The new driver will almost certainly find that their motor insurance premiums have increased substantially, and are very expensive in their first few years of driving. This is because new drivers make more insurance claims, and more expensive claims, than experienced drivers. However, there are ways to reduce the cost:

Choose a telematics-based motor insurance policy

Encourage the new driver to choose an insurance policy that uses telematics - this will help the new driver to drive in a safe and responsible manner, and avoid high risk situations because how they drive will affect their insurance premium. However, it is important that the driver regularly views the feedback about their driving that the telematics provides. It is also very useful if the parent(s) regularly sees and discusses it with the young driver. Research shows that driving improves more when the feedback is viewed.

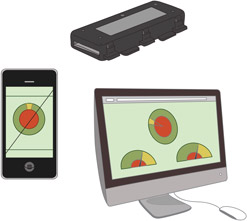

Many motor insurers offer policies that use telematics, usually by having a small device (a 'black box') retro-fitted in the vehicle, or by using an app on a smartphone. Some policies begin with an app, as a way of trying the telematics, before having a black box fitted if the policy seems right for the driver.

Using telematics is a very useful way of helping new drivers improve their driving and obtain reduced insurance premiums. It can significantly reduce risky driving.

If the driver is driving responsibly and avoiding high risk situations (such as driving in the early hours) she or he gets a higher score, and possibly a discount on their premiums or another benefit (such as more miles). But, if the driver drives poorly (for example, speeding, or harsh acceleration and braking), they get a lower score and their premiums may increase.

Telematics also shows the driver what's good and bad about their driving and provides advice about they can change their driving to reduce risks and improve their score. Young drivers are more likely to improve their driving when they and their parents view this feedback.

Avoid cars in a High Insurance Group

The insurance group significantly affects the cost of insurance. Cars in high insurance groups tend to be more powerful and so increase the crash risk. So, they cost more to insure.